Commercial links between Singapore and Russia are growing. This progress was recently noted after the sixth session of the High-Level Russia-Singapore Inter-Governmental Commission (IGC) which took place in Moscow. The event was chaired by Mr Tharman Shanmugaratnam, the Deputy Prime Minister and Coordinating Minister for Economic and Social Policies along with Mr. Igor Shuvalov, the First Deputy Prime Minister of the Russian Federation.

There is interest by Singapore’s offshore and marine companies to have opportunities in Russia. Food production companies in both companies are also interested in having cross-border exports.

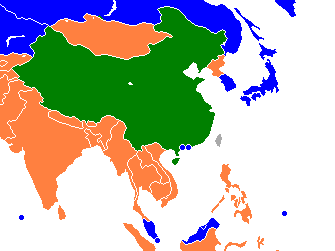

Both countries have agreed to start the process to negotiate for a comprehensive free trade agreement between Singapore and the Eurasian Economic Union (EAEU).