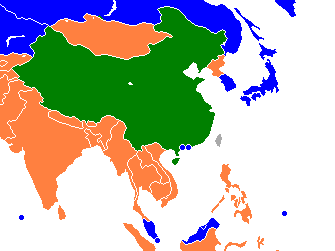

Optimism is rising for making investments into the Asia Pacific region. There is greater confidence among executives in the region, a large percentage of whom, according to a PwC report believe that in the next 12 months there will be substantial growth. Given that it has risen 10 points from 2012 and four from 2013, this is a good sign.

However, growth has not been encountered all that much in China. So will this impact the rest of the Asia Pacific region? According to the study, 67 percent of executives are anticipating that they will make large investments in the APEC region over the next year. And they will be doing this within each of the 21 member economies. As well, China is actually up there as one of the most popular places for such investments.

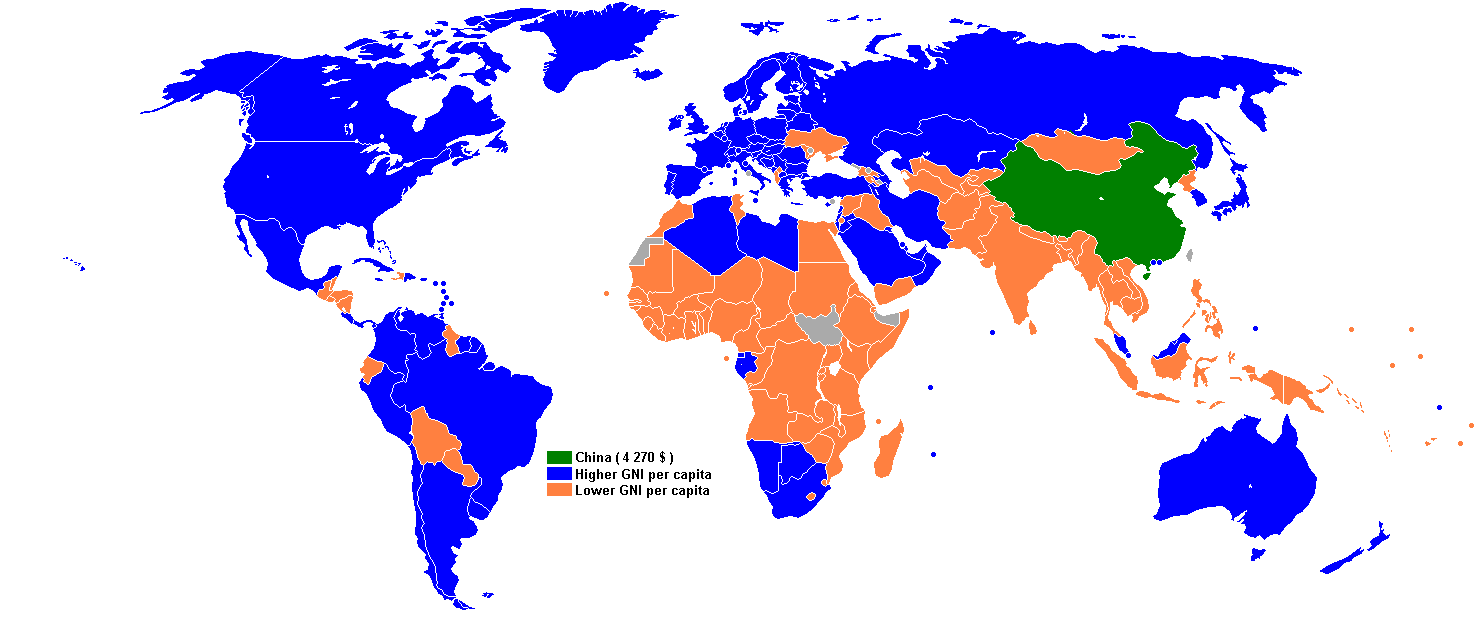

If that is the case, how do investors justify these plans if China’s economy is not encountering growth? A couple of weeks ago, Bob Davis at ‘The Wall Street Journal,’ wrote that “we are witnessing the end of the Chinese economic miracle.”

However, just recently China started admitting its issues – which is a huge deal vis-à-vis solving them. It announced a drop in interest rates which will once again begin to make the region more attractive to outside investors.

Still, there is much more to be done. The facts are that the country’s manufacturing sector is facing challenging overcapacity, resulting in a drop in prices. As well, there was an increase of GDP in the third quarter by 7.3 percent. These issues have to be addressed as well as interest rates, if China is going to have a chance of getting back in the foreign investment game.